Real Estate Reno Nv Can Be Fun For Everyone

Real Estate Reno Nv Can Be Fun For Everyone

Blog Article

The Greatest Guide To Real Estate Reno Nv

Table of ContentsSome Ideas on Real Estate Reno Nv You Should KnowReal Estate Reno Nv Fundamentals ExplainedReal Estate Reno Nv Can Be Fun For EveryoneFascination About Real Estate Reno Nv

That might show up expensive in a world where ETFs and common funds might charge as little as zero percent for constructing a varied profile of stocks or bonds. While systems might vet their investments, you'll need to do the exact same, and that means you'll require the skills to analyze the possibility.Caret Down Resources appreciation, reward or rate of interest payments. Like all financial investments, genuine estate has its pros and cons. Right here are several of one of the most important to remember as you evaluate whether or not to purchase genuine estate. Long-term admiration while you reside in the property Possible hedge versus inflation Leveraged returns on your investment Easy earnings from rental fees or with REITs Tax benefits, including rate of interest deductions, tax-free capital gains and devaluation write-offs Repaired lasting financing readily available Recognition is not guaranteed, particularly in financially depressed areas Home rates might drop with higher rate of interest prices A leveraged financial investment indicates your deposit goes to risk Might require considerable time and cash to manage your own residential properties Owe an established mortgage settlement on a monthly basis, also if your renter does not pay you Reduced liquidity for real building, and high commissions While property does supply many advantages, particularly tax obligation benefits, it doesn't come without significant downsides, particularly, high commissions to exit the market.

Or would certainly you choose to examine bargains or investments such as REITs or those on an on-line system? Knowledge and skills While lots of capitalists can find out on the job, do you have unique skills that make you better-suited to one type of financial investment than one more? The tax obligation advantages on genuine estate vary widely, depending on just how you spend, yet spending in actual estate can provide some large tax benefits.

The 3-Minute Rule for Real Estate Reno Nv

REITs provide an eye-catching tax obligation account you won't incur any funding gets tax obligations up until you sell shares, and you can hold shares actually for decades to avoid the tax obligation man. You can pass the shares on to your heirs and they will not owe any kind of tax obligations on your gains (Real Estate Reno NV).

Realty can be an appealing investment, but investors wish to make sure to match their kind of go to my blog financial investment with their determination and ability to handle it, consisting of time dedications. If you're seeking to produce income during retired life, property investing can be one method to do that.

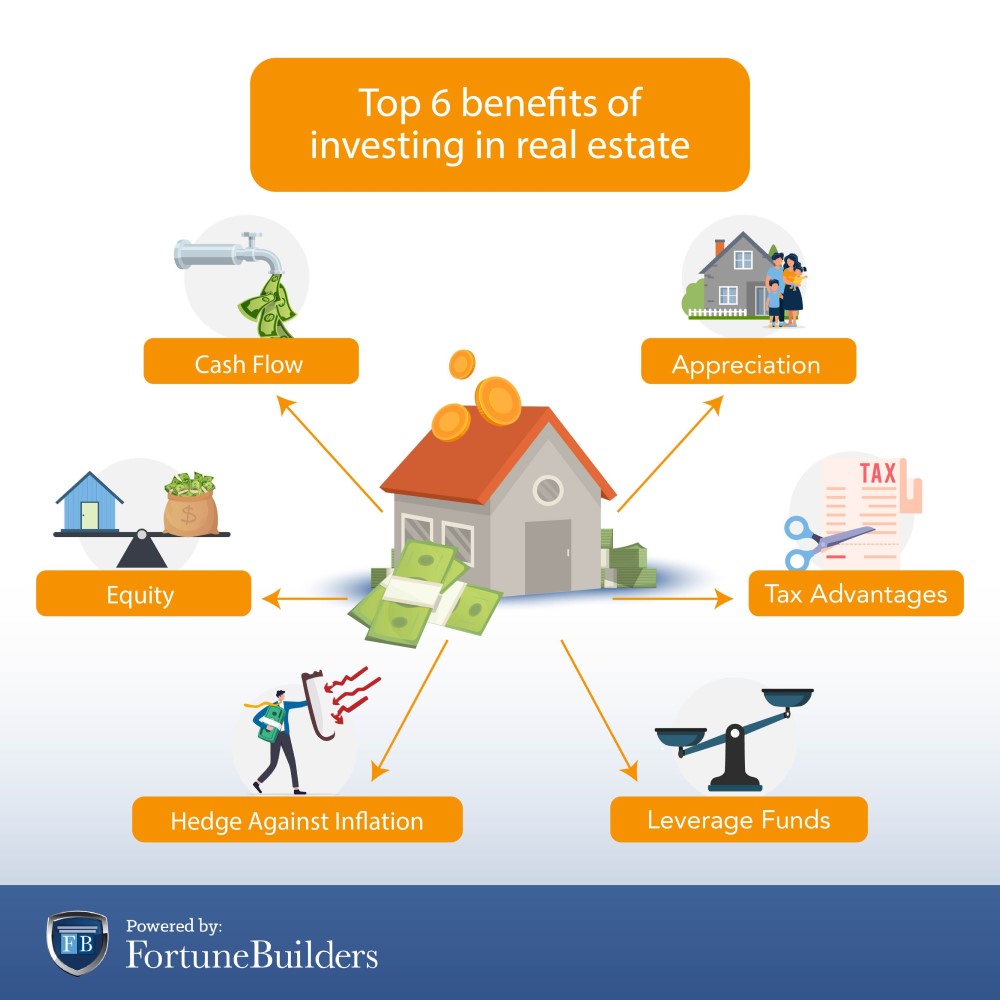

There are numerous benefits to purchasing realty. Constant income circulation, solid yields, tax advantages, diversification with well-chosen properties, and the capability to leverage wide range through real estate are all advantages that capitalists may appreciate. Right here, we delve right into the different benefits of buying property in India.

3 Simple Techniques For Real Estate Reno Nv

Actual estate tends to value in worth over time, so if you make a wise financial investment, you can profit when it comes time to market. Over time, leas additionally tend to enhance, which may raise capital. Leas raise when economic climates increase due to the fact that there is more demand for genuine estate, which elevates resources values.

One of the most eye-catching resources of passive income is rental income. One of the simplest approaches to keep a stable earnings after retired life is to do this. If you are still functioning, you might increase your rental revenue by spending it following your economic objectives. There are various tax benefits to property investing.

5 lakh on the principle of a mortgage. In a similar vein, area 24 allows a decline in the required interest payment of approximately Rs 2 lakhs. It will drastically decrease gross income while reducing the expense of real estate investing. Tax reductions are given for a range of expenses, such as company expenditures, capital from various other possessions, and mortgage passion.

Property's link to the other primary possession groups is vulnerable, at times also negative. Actual estate may therefore minimize volatility and boost return on danger when it is consisted of in link a portfolio of different assets. Contrasted to various other possessions like the stock exchange, gold, cryptocurrencies, and banks, buying property can be considerably more secure.

Some Known Details About Real Estate Reno Nv

The stock exchange is continually changing. The realty market has grown over the past a number of years as an outcome of the execution of RERA, decreased home finance passion rates, and various other factors. Real Estate Reno NV. The helpful hints interest rates on bank interest-bearing accounts, on the other hand, are low, particularly when contrasted to the increasing inflation

Report this page